Fatca Deadline 2025

Fatca Deadline 2025. The deadline for uae’s reporting financial institutions (rfis) to submit reports in accordance with the foreign account tax compliance act (fatca). The commissioner for revenue published a new version of the guidelines for fatca and crs in february 2025.

The commissioner for revenue published a new version of the guidelines for fatca and crs in february 2025. Fatf announcement of uae completion of the requirements is a testament of concerted.

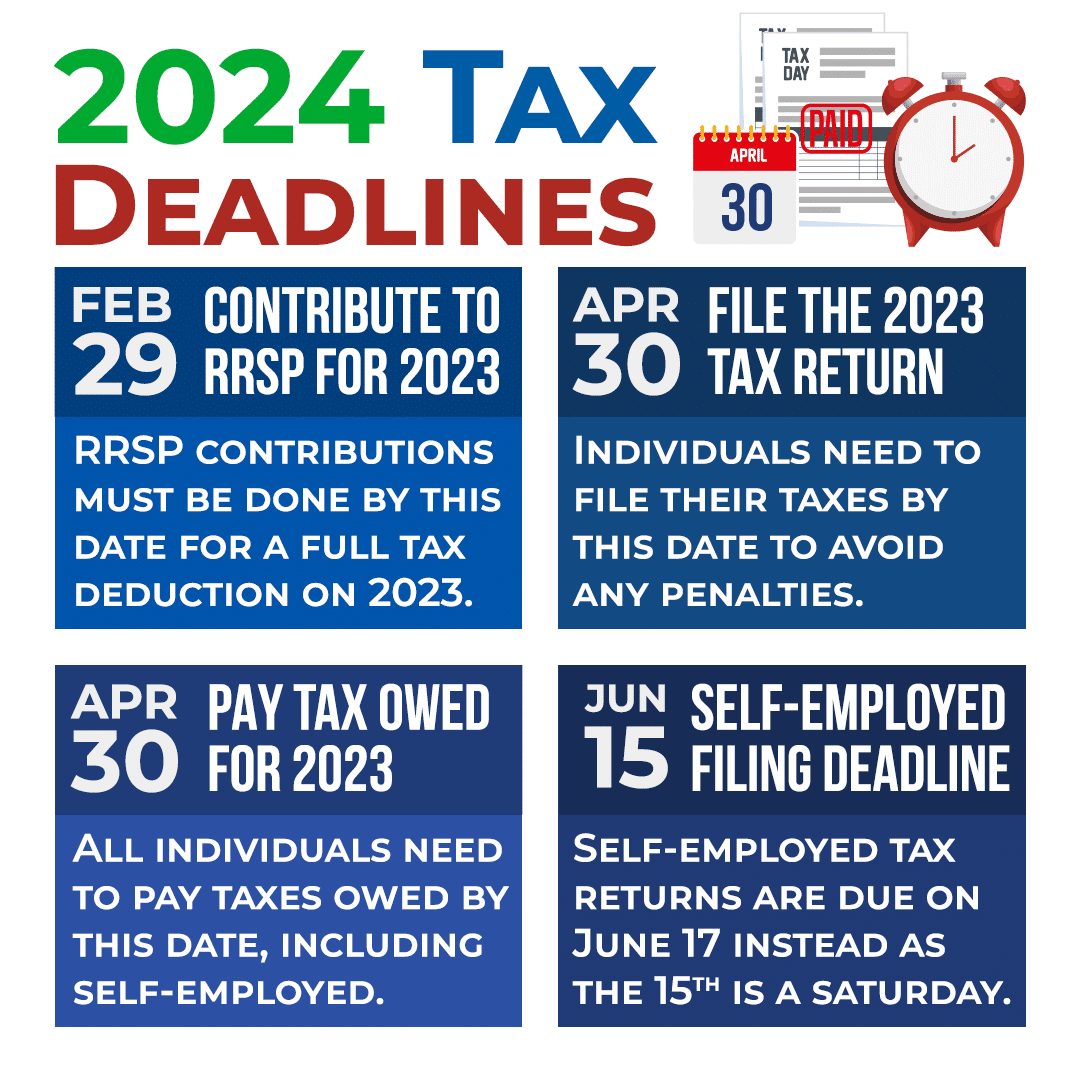

Common Reporting Standard and FATCA Deadline Approaching Bransens, However, this deadline automatically extends two months to june 17, 2025, for us citizens. The commissioner for revenue published a new version of the guidelines for fatca and crs in february 2025.

Tax Filing Deadline 2025 Usa Trude Gertrude, How can technology be used to simplify compliance? Sebi/ho/mirsd/secfatf/p/cir/2025/12 centralization of certifications under foreign account tax compliance act (fatca) and common.

Cayman Islands FATCA & CRS Deadline Reminder ComplyPro, Sebi/ho/mirsd/secfatf/p/cir/2025/12 centralization of certifications under foreign account tax compliance act (fatca) and common. Colombia has its fatca deadline on the 27th of july, and portugal has it on the 31st of july.

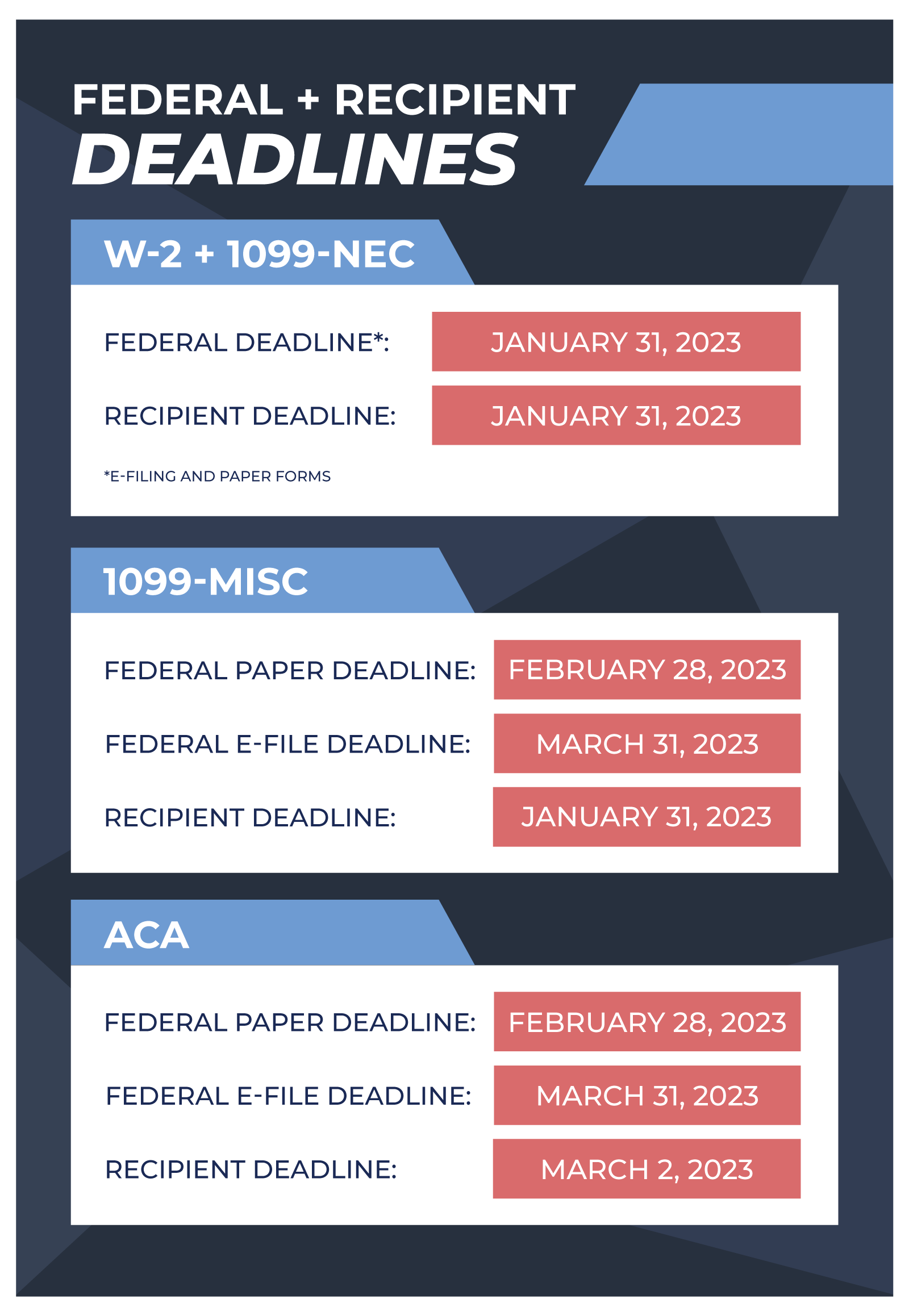

Beware of FATCA Notices of Default After FATCA Certification Deadlines!, Date by which strike off application must be submitted for an. Fatca and crs reporting deadlines for 2025.

Cayman Islands FATCA Compliance Deadlines Extended Again US, Fatf announcement of uae completion of the requirements is a testament of concerted. The foreign account tax compliance act (fatca), which was passed as part of the hire act, generally requires that foreign financial institutions and certain.

Canada Tax Filing Deadlines 2025 Advanced Tax Services, The foreign account tax compliance act (fatca) requires us expats with significant offshore. Fatca requires foreign financial institutions (ffis) to report to the irs information about financial accounts held by u.s.

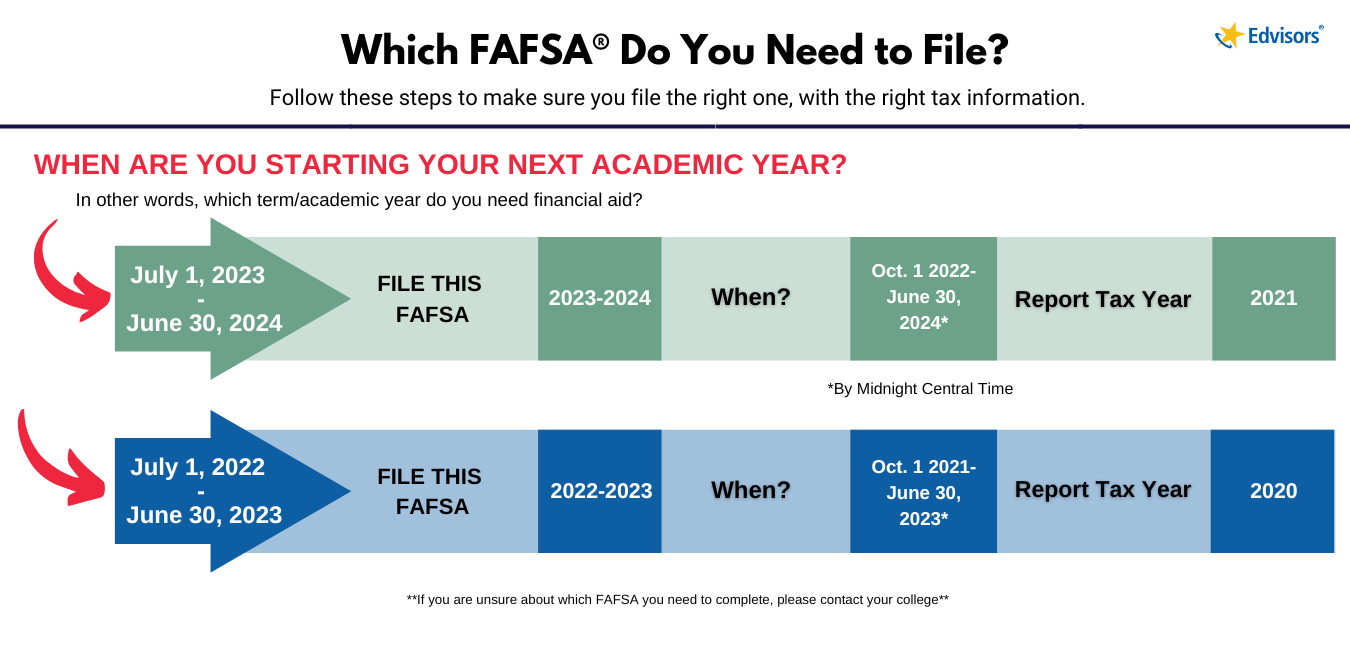

What Is The Deadline For Fafsa 2025 Kira Randee, The foreign account tax compliance act (fatca), which was passed as part of the hire act, generally requires that foreign financial institutions and certain. What are the common challenges in crs and fatca reporting?

[Infographic] As the FATCA deadline approaches (tax authorities must, 2025/2, announcing the june 30 deadline for financial institutions to submit calendar year 2025 u.s. The bahamas competent authority advises that the aeoi portal will open for fatca & crs on monday july 8 th 2025 at 9 am est and close on friday august 23 rd.

![[Infographic] As the FATCA deadline approaches (tax authorities must](https://i.pinimg.com/736x/49/e3/39/49e33936ab75c48d02a85bfbf5f454e6--for-the-data.jpg)

All you need to know about FATCA Deadline, procedure and details The, On 29 june 2025, the irish revenue commissioners (“revenue”) deferred the irish fatca and crs filing deadline for the 2025 reporting period from 30 june 2025 to 14 july. 2025/2, announcing the june 30 deadline for financial institutions to submit calendar year 2025 u.s.

April deadline for FATCA compliance India Business Law Journal, Colombia has its fatca deadline on the 27th of july, and portugal has it on the 31st of july. Taxpayers, or by foreign entities in which u.s.

Sebi/ho/mirsd/secfatf/p/cir/2025/12 centralization of certifications under foreign account tax compliance act (fatca) and common.

The commissioner for revenue published a new version of the guidelines for fatca and crs in february 2025.